A Beginner’s Guide to Budgeting: How to Improve Your Business Strategy

Welcome to our beginner’s guide on budgeting! Budgeting is a crucial aspect of any business strategy, as it helps companies manage their finances efficiently and effectively. Whether you’re a small start-up or a large corporation, understanding how to budget is essential for long-term success. In this article, we will dive into the basics of budgeting and provide you with valuable tips and strategies to improve your financial planning. So, whether you’re looking to optimize your current budget or create a new one from scratch, keep reading to learn all about budgeting and how it can benefit your business.

First, let’s define budgeting. It is the process of creating a financial plan that outlines the expected income and expenses for a specific period. Budgeting helps businesses to manage their finances efficiently by providing a clear picture of their financial situation. As such, it is an essential tool for strategic planning and decision-making.

To create an effective budget, you need to consider various factors, including your company’s goals, market trends, and financial resources. A well-structured budget should include both short-term and long-term goals and align with your overall business strategy.

Now that you understand the basics of budgeting let’s look at its impact on business strategy. A sound budget can help your organization in various ways, such as:

- Strategic Planning: A budget provides a roadmap for achieving your business goals and objectives. By outlining your projected income and expenses, you can identify areas that need improvement and make strategic decisions accordingly.

- Resource Allocation: With a budget in place, you can allocate resources effectively and ensure that your company’s operations run smoothly. This is crucial for the success of any business strategy.

- Risk Management: Budgeting also helps in identifying potential risks and creating contingency plans to mitigate them. By considering different scenarios in your budget, you can prepare your business for any unexpected challenges.

Next, let’s discuss the key components of budgeting that you need to consider for your business strategy:

- Income: This includes all the sources of revenue for your business, such as sales, investments, and loans.

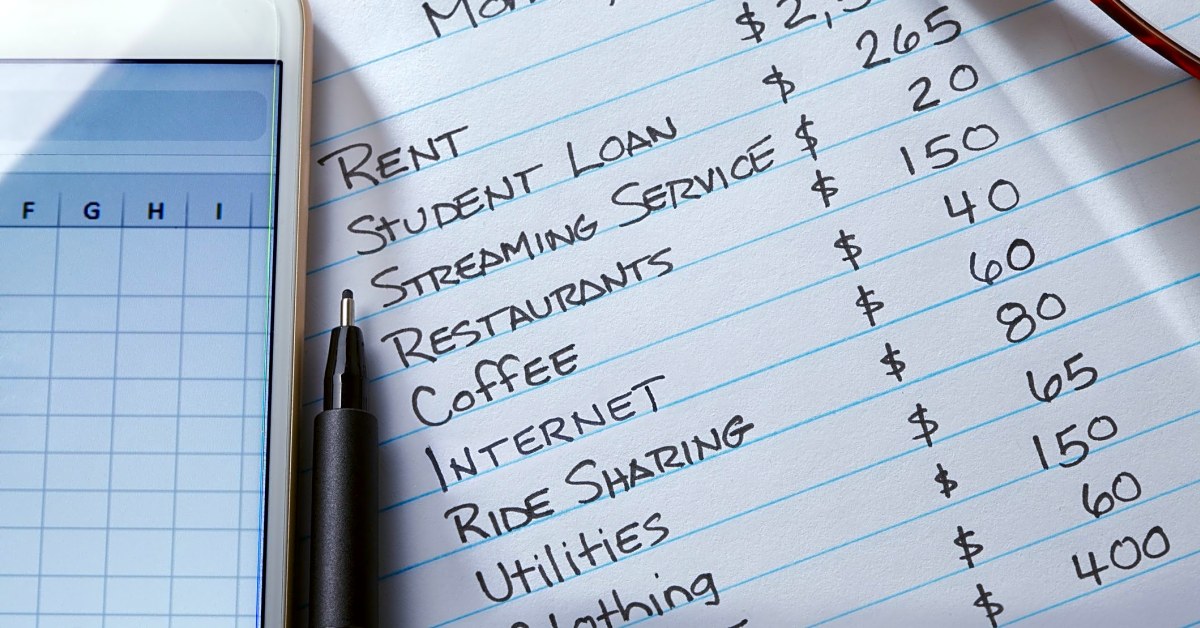

- Expenses: These are the costs incurred by your business, such as rent, utilities, payroll, and marketing.

- Cash Flow: This refers to the movement of money in and out of your business. A positive cash flow is essential for sustaining your operations and implementing your business strategy.

- Budget Variance: This is the difference between your actual income and expenses and the budgeted amount. Tracking budget variance can help you identify areas for improvement and make necessary adjustments.

In conclusion, budgeting plays a crucial role in improving your business strategy. By creating a realistic budget and regularly reviewing and adjusting it, you can make informed decisions that will drive your organization towards success. Remember to consider all the key components of budgeting and align your budget with your overall business goals. Now it’s time to put these budgeting tips into action and take your strategy consulting skills to the next level!

The Importance of Budgeting for Business Strategies

As a business owner or strategy consultant, you may already know the importance of budgeting for the success of a business. A budget serves as a financial roadmap, outlining the necessary expenses and revenue projections for a specific period of time. It allows businesses to plan and allocate resources effectively, ensuring that they are being used in the most efficient and strategic way.

But why does budgeting matter for business strategies? For starters, it helps businesses stay on track and achieve their goals. Without a budget in place, it is easy for businesses to overspend or lose focus on their objectives. By setting specific targets and monitoring progress through budgeting, businesses can make informed decisions and adjust their strategies accordingly.

Budgeting also plays a crucial role in risk management. By forecasting potential expenses and preparing for them, businesses can minimize the impact of unexpected events and maintain stability. This is especially important for small businesses with limited resources, as any financial setback can have a significant impact on their operations.

Furthermore, budgeting promotes accountability within an organization. By involving key stakeholders in the budgeting process and setting clear expectations, businesses can ensure that everyone is aligned and working towards the same goals. This not only improves communication and collaboration but also motivates employees to be more mindful of their spending and contribute to the overall success of the business.

Key Components of Budgeting

Budgeting is a crucial aspect of any business strategy, and it involves carefully planning and managing the financial resources of an organization. In order to create an effective budget, there are several key components that must be included. These components will help you make informed decisions and ensure that your budget is aligned with your overall business goals.

1. Revenue Projections: One of the first steps in budgeting is to project your revenue for the upcoming period. This can be based on past performance, market trends, and any anticipated changes in your industry. It is important to be realistic when making revenue projections, as this will directly impact the rest of your budget.

2. Fixed and Variable Costs: Another crucial component of budgeting is identifying and categorizing your fixed and variable costs. Fixed costs are expenses that remain the same every month, such as rent or salaries, while variable costs fluctuate based on business activity. By understanding these costs, you can better allocate resources and make adjustments as needed.

3. Contingency Fund: It is important to include a contingency fund in your budget to account for any unexpected expenses or emergencies. This will help you avoid financial strain and maintain stability in your business operations.

4. Capital Investments: If your business requires any major investments, such as equipment or technology upgrades, it is important to include these in your budget. This will help you plan for these expenses and ensure that they are aligned with your overall financial goals.

5. Performance Tracking: Finally, it is important to include a system for tracking and monitoring your budget performance. This will allow you to make adjustments as needed and ensure that you are staying on track towards your financial goals.

By including these key components in your budgeting process, you can create a comprehensive and effective budget that will help you achieve success in your business strategy.

Budgeting is not a one-time task but an ongoing process. It requires regular monitoring, review, and adjustments to ensure its effectiveness. By following the tips outlined in this article, you can create a solid budget that will support your business strategy and drive your organization towards success.

Related Posts

Explore the Key Components of Budgeting and Their Impact on Business Strategies