Developing Risk Management Plans for Business Strategy

In today’s ever-changing business landscape, it is crucial for companies to have a comprehensive risk management plan in place. With the increasing complexity of global markets and the constant threat of unforeseen events, businesses must be proactive in identifying and mitigating potential risks that could negatively impact their operations. This is where developing risk management plans comes into play. By strategically analyzing potential risks and implementing effective risk management strategies, companies can not only protect their bottom line but also gain a competitive advantage in the market. In this article, we will delve into the importance of developing risk management plans for business strategy and how it fits into the larger silo of strategic and risk analysis. From understanding the concept of risk management to its role in overall business strategy, we will cover all aspects of this crucial process. So, let’s dive in and explore how developing risk management plans can help your business succeed in today’s dynamic environment.

In today’s fast-paced business world, having a strong risk management plan is essential for any organization looking to succeed. Companies must be prepared to handle unexpected challenges and mitigate potential risks in order to maintain a competitive advantage. For those seeking guidance on how to improve their business strategy, this article will provide a comprehensive overview of developing risk management plans and its importance in strategic consulting.

Firstly, it is important to understand that risk management is not just about avoiding negative outcomes, but also about taking calculated risks that can lead to growth and innovation. This requires businesses to follow a structured process that involves identifying, assessing, and mitigating potential risks.

The first step in this process is risk identification. This involves identifying all potential risks that could impact the success of a business strategy. This could include internal risks such as human error or system failures, as well as external risks such as economic downturns or changes in market trends. By being proactive and identifying these risks early on, businesses can better prepare and minimize their impact.

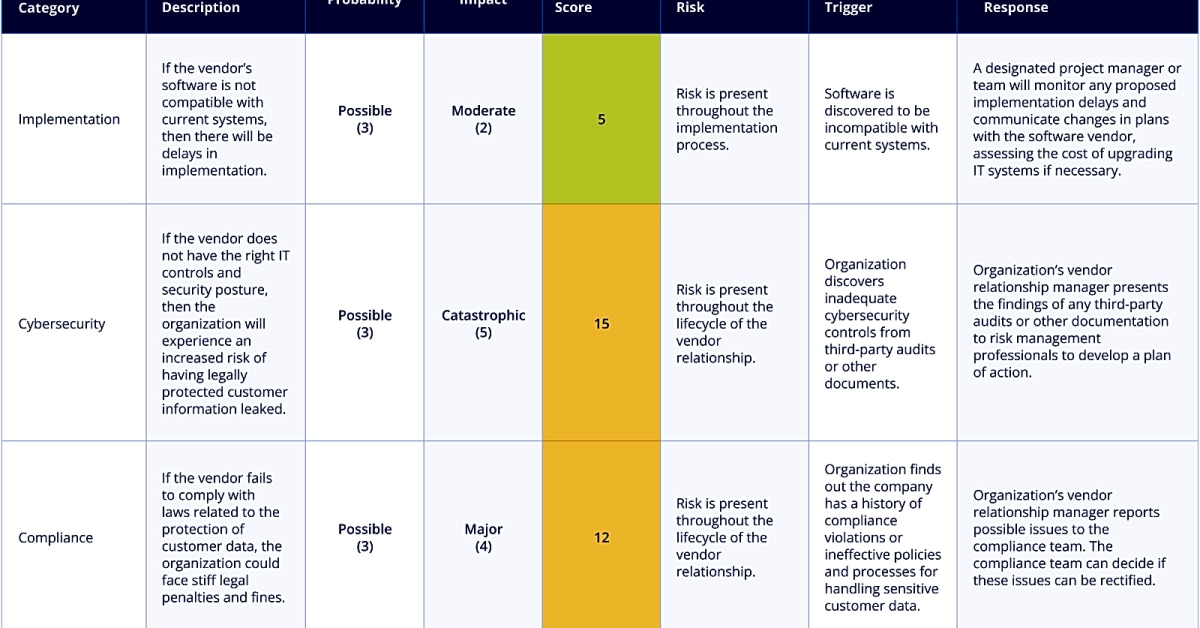

Next is risk assessment, where businesses must determine the likelihood and potential impact of each identified risk. This can be done through various methods such as qualitative analysis, quantitative analysis, or a combination of both. By understanding the level of risk associated with each potential threat, businesses can prioritize their resources and efforts accordingly.

Once risks have been identified and assessed, the next step is risk prioritization. This involves ranking the identified risks based on their level of importance and potential impact on the business. By prioritizing risks, businesses can focus on addressing the most critical threats first and then move on to less significant ones.

The final step in developing a risk management plan is risk mitigation. This involves implementing strategies and measures to minimize or eliminate the identified risks. These strategies could include implementing new policies or procedures, investing in new technology, or creating contingency plans. The goal of risk mitigation is to reduce the likelihood and impact of potential risks, ultimately helping businesses achieve their strategic objectives.

In conclusion, developing a risk management plan is crucial for any business looking to succeed in today’s fast-paced and unpredictable business landscape. By following a structured process of risk identification, assessment, prioritization, and mitigation, businesses can effectively manage potential threats and improve their overall business strategy. It is important for businesses to understand that risk management is not just about avoiding negative outcomes, but also about taking calculated risks that can lead to growth and innovation.

Risk Identification: Engaging Stakeholders to Uncover Business Risks

The first step in developing a risk management plan is identifying potential risks that may impact your business. This can include both internal and external factors such as economic changes, market trends, and operational issues. It is important to involve key stakeholders in this process to ensure all areas of the business are considered.

Risk Assessment

Once risks have been identified, the next step is to assess the likelihood and impact of each risk. This involves gathering data and analyzing the potential consequences of each risk. By understanding the level of risk associated with each potential issue, businesses can prioritize their resources and focus on the most critical areas.

Risk Prioritization

After assessing the risks, businesses must prioritize which risks to address first. This can be done by considering the severity of the potential impact and the likelihood of it occurring. It is important to also consider the resources and capabilities needed to address each risk.

Risk Mitigation

The final step in developing a risk management plan is implementing strategies to mitigate the identified risks. This can include creating contingency plans, implementing new processes or procedures, or investing in insurance policies. The goal is to minimize the impact of potential risks and have a plan in place to handle them if they do occur.

In conclusion, developing a risk management plan is crucial for businesses looking to improve their overall strategy. By following a structured process and involving key stakeholders, companies can proactively identify and mitigate potential risks, leading to more effective decision-making and a competitive advantage. Strategic analysis and risk analysis go hand in hand, as understanding potential risks is essential for developing a strong business strategy. By implementing a comprehensive risk management plan, businesses can confidently navigate challenges and drive growth.

Related Posts

Learn the key steps to developing risk management plans and how it can improve your business strategy. Find resources on strategic planning, organizational strategy, and leadership.